5 Practical Ways to Save Up for a House in a Year

Grit, discipline and commitment. Three words to make saving for a house in a year achievable.

This guide will work to assist you homebuyers preparing for your new year resolution - An ultimate game plan to get your finances in check to buy a house by the end of the year!

From this article, you will take away golden nuggets on goal setting and budgeting, cutting your expenses, credit score, where to invest a portion of your savings and ways to boost your income.

1. Goal Setting and Budgeting

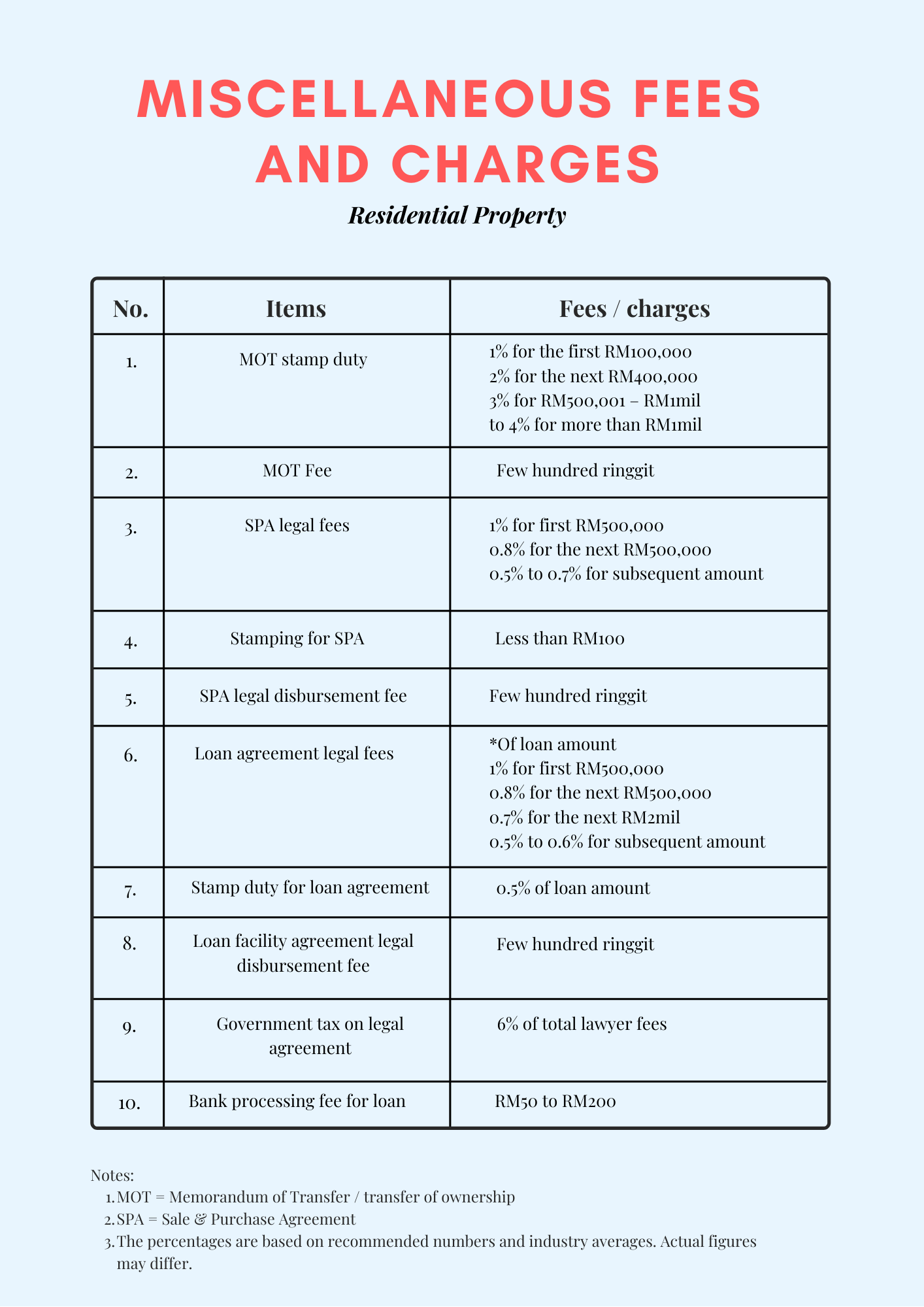

Miscellaneous Fees and Charges

There is more than just the first 10% downpayment and monthly repayment when buying a house. You also need to prepare for all the miscellaneous fees and other charges that are involved in purchasing a residential property.

In Malaysia, financial assistance and incentives are available from the government and developers to absorb most of the upfront cost for new projects. However, this is not applicable to the sub-sale market and would require you to make full upfront payment. Image by Property Hunter.

In Malaysia, financial assistance and incentives are available from the government and developers to absorb most of the upfront cost for new projects. However, this is not applicable to the sub-sale market and would require you to make full upfront payment. Image by Property Hunter.

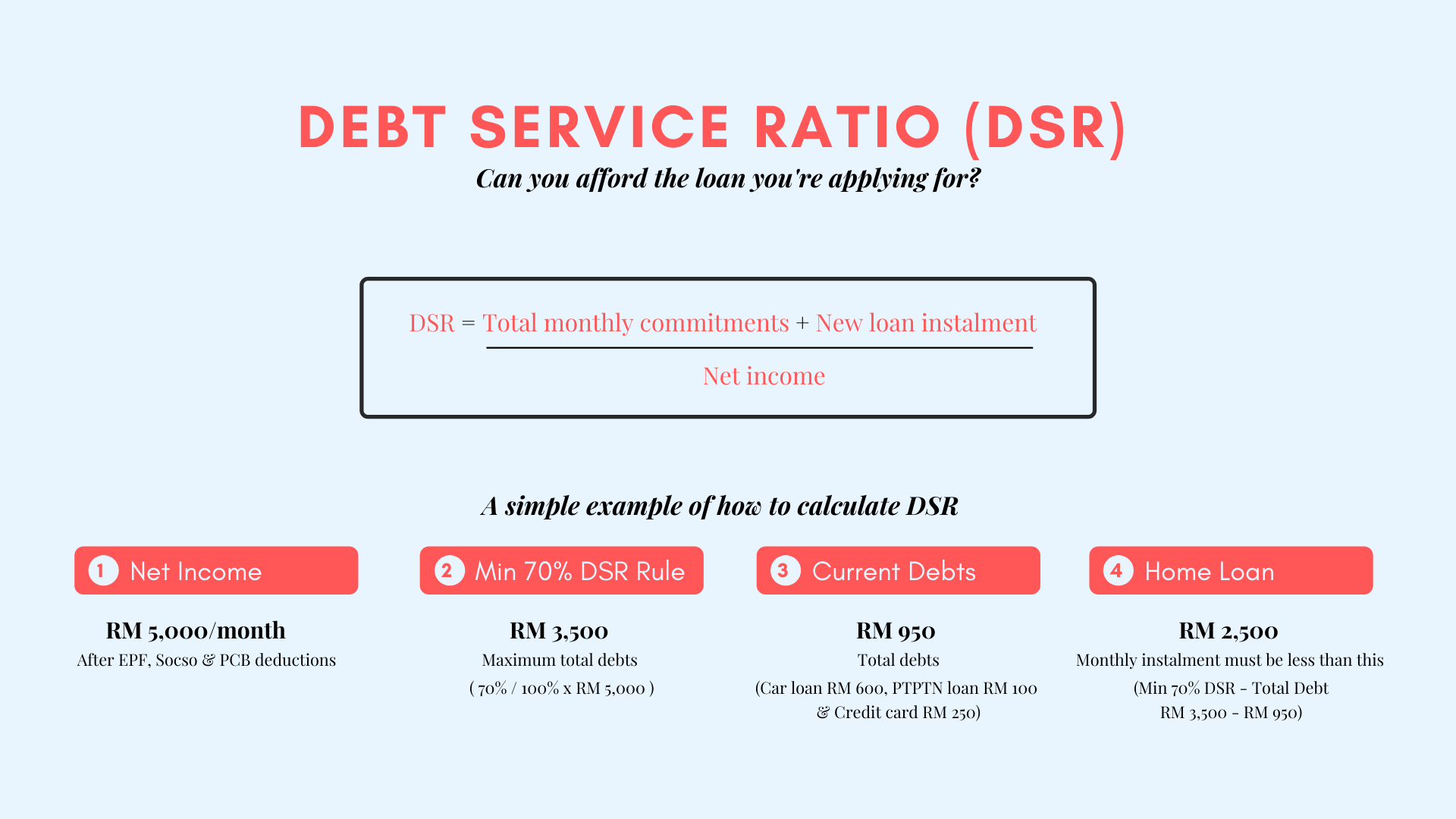

Debt Service Ratio (DSR) & Home Loan Eligibility

The Debt Service Ratio (DSR) shows how much of a person’s income is used to pay debt instalments, represented as a percentage (%) of income. It helps you to figure out how much you can borrow from the bank to finance your house.

Next, do a preliminary check on your loan eligibility with a home loan calculator. Take into consideration the loan margin because it will determine how much is the upfront payment you need to pay. Most banks offer 90% loan for the first house depending on your credit score and the remaining 10% will be paid by you.

Different banks can have major differences in the final DSR calculated because every bank has their respective calculation methods for income and commitment. Image by Property Hunter.

Different banks can have major differences in the final DSR calculated because every bank has their respective calculation methods for income and commitment. Image by Property Hunter.

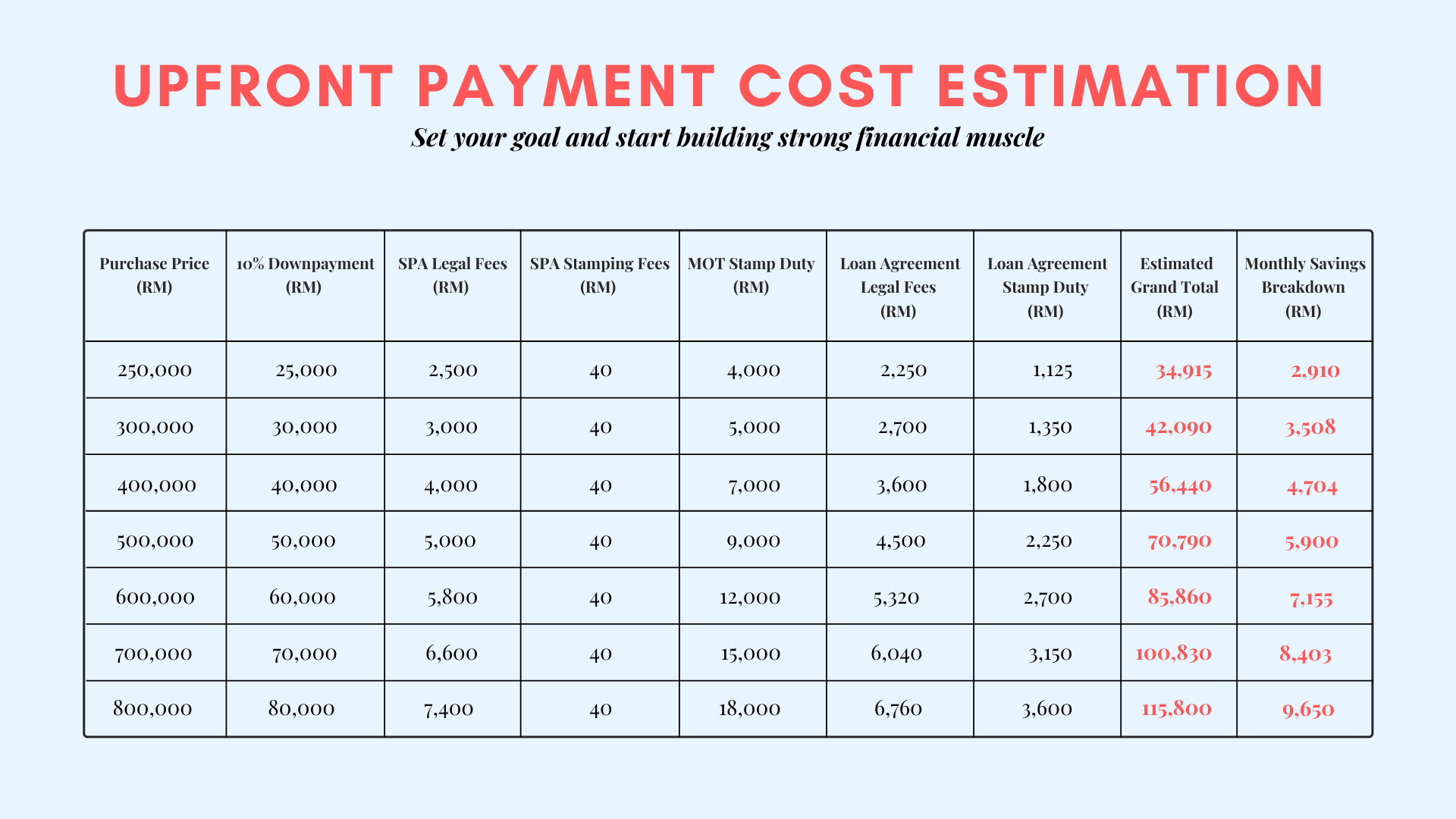

Upfront Payment Estimation

You can now figure out how much is the monthly instalment you can afford to pay after completing the DSR calculation and a preliminary check on home loan eligibility. This will also give you a clue on the property purchase price that fits your budget.

Most developers for new projects absorb legal fees when you purchase their unit which can help you to cut down on the upfront cost. Do check with the respective developers on what they are offering.

If you are eligible, financial assistance is also available from the government. While the Home Ownership Campaign (HOC) package is only valid until May 2021, you may try to obtain the RM30,000 incentives from MyHome Scheme.

Note that the goal is to save up to buy a house in a year and you can always adjust your budget according to your target. Image by Property Hunter.

Note that the goal is to save up to buy a house in a year and you can always adjust your budget according to your target. Image by Property Hunter.

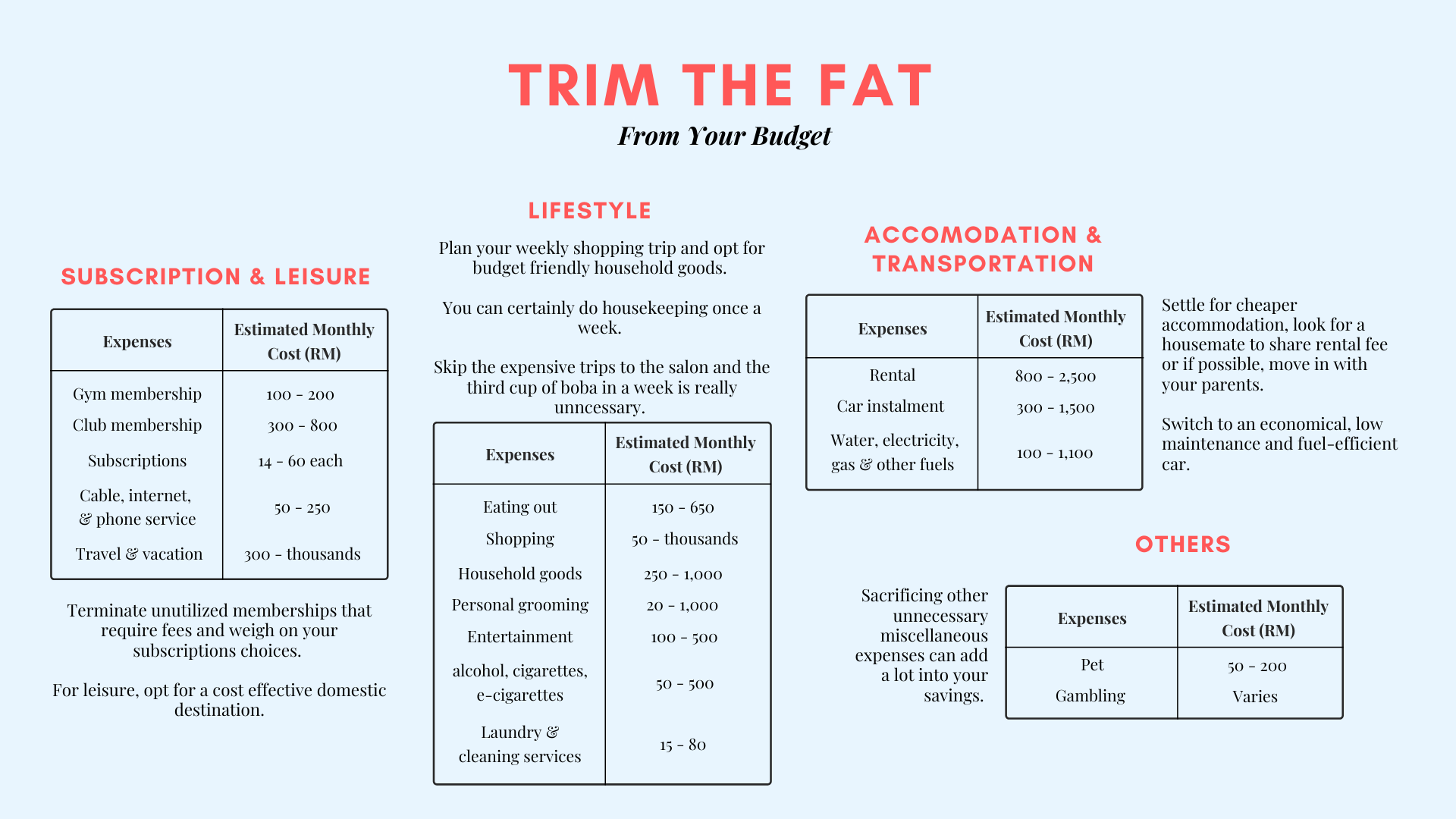

2. Downsize your expenses

Track your expenses diligently. You'll be surprised how much small expenses could add up very quickly.

Estimated Monthly Cost is an estimation of the average range of monthly cost on each item. It may vary from each individual. Image by Property Hunter.

Estimated Monthly Cost is an estimation of the average range of monthly cost on each item. It may vary from each individual. Image by Property Hunter.

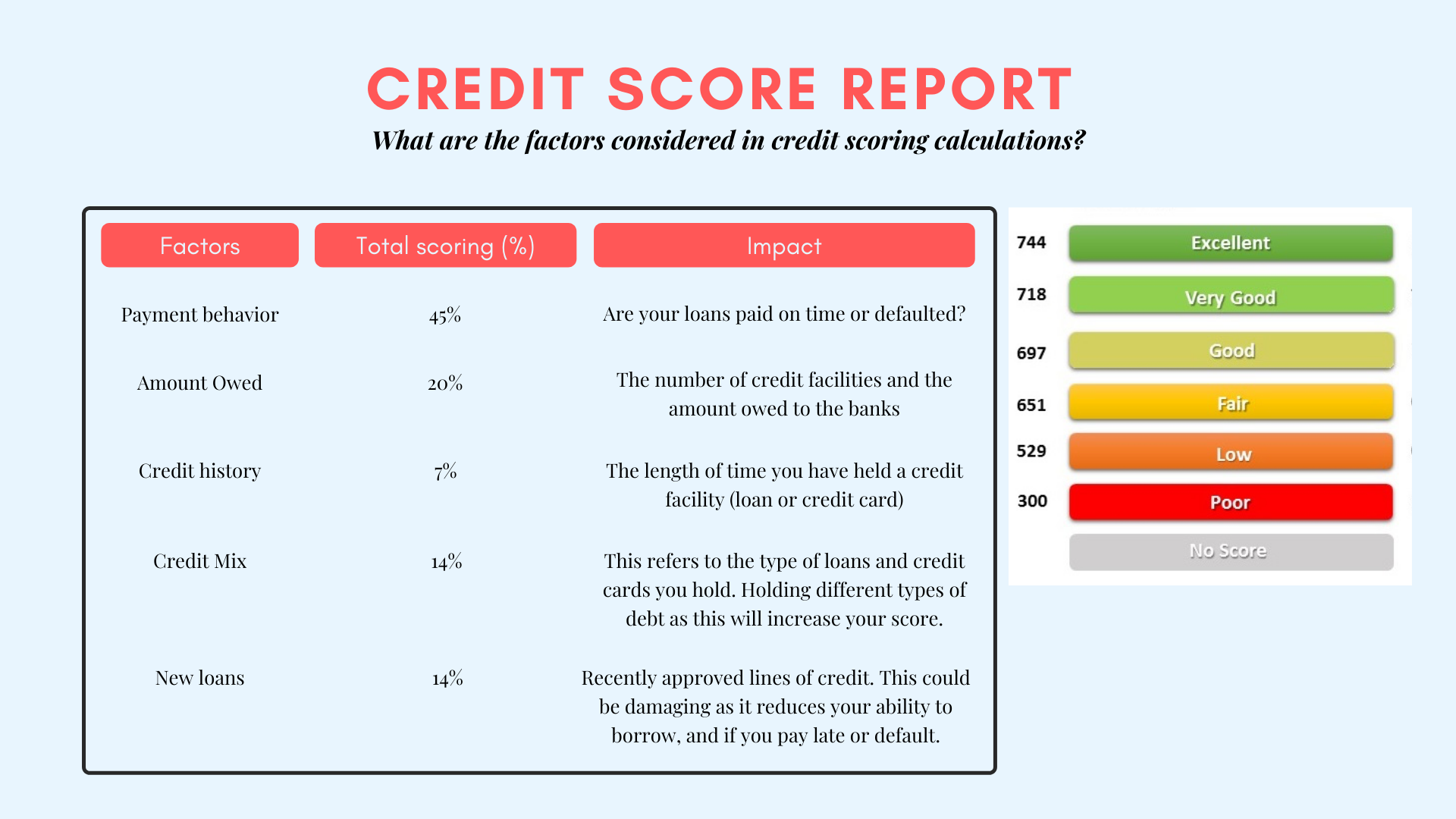

3. Maintain a healthy credit score

Start maintaining a healthy credit score and make timely payments. Defaulting your existing loan repayments will drastically reduce your credit score and affect your ability to receive future credit.

What is a credit score?

A three digits score between 300 (poor) and 850 (excellent). It represents your financial health and how likely you are to repay debt. On top of DSR, banks and lenders also look at your credit score to evaluate your application for credit or loans.

Why is it important?

It plays an important role when you want to apply for loans from a bank. Since your credit score is an indicator of your financial health, it helps banks to understand the risks they might face if they lend you money.

Benefit from maintaining a good credit score

The higher your score, the better the chances of getting your applications approved.

Negotiate for a better deal such as lower interest rates or flexible payment.

A good credit score is favourable, making more banks prefer to deal with you. Therefore, giving you more options to choose from.

Banks typically look into the past 3- 6 months of your credit record. Image by Property Hunter.

Banks typically look into the past 3- 6 months of your credit record. Image by Property Hunter.

4. Don’t just save your money, invest smartly

You also need extra help to grow your savings by investing in high-yield, low-risk investments.

Ways to invest your money:

1. Deposit into a high-yield saving account offered by banks.

2. If you are a Bumiputera, stash an amount into your personal Amanah Saham Berhad (ASB) account.

3. For stock investment, look into top listed companies of Bursa Malaysia or blue chip companies.

5. Boost income

Get a side hustle on top of your full-time job to boost your income. Brought value to your company? Negotiate for a pay raise from your employer.

Here are some ideas you can explore to increase your income:

1. Grab driver

2. Fitness trainer

3. Bookkeeping

4. Beauty services

5. Virtual assistant

6. Freelance writing (Have articles on real estate that you would like us to feature? Send it to us!)

7. Sell pre-loved items

8. Sell food & beverages

9. Social media management

10. Creative & artistic services

11. Photographer / Videographer

12. Tutoring - School subject, language, music

Hopefully, this article will give an insight and guide for all Malaysians who are planning to save up for a house upfront payment in a year. We are wishing you all the best and a great start to 2021!