7 Entry Costs of Buying a Property

Before owning your first home, you should know the fees and costs of buying one.

First-time homebuyers often think they are ready to sign on the dotted line when they determine that their savings and monthly income are sufficient to cover the down payment and monthly payments for the purchase. However, what is often overlooked is the additional costs they will need or want to incur for their new purchase.

Besides the down payment, there are some costs that will be incurred which are also important but often tend to be forgotten by people when planning to buy property.

You can now download the Tax Guide: Buy, Rent & Sell ebook.

Buyers can enjoy stamp duty and other fees exemption under the Home Ownership Campaign (HOC), which has been extended until December 2021.

T1. Down Payment Minimum

A down payment is a mandatory lump sum payment made in advance of the purchase of a property, whether it is purchased from a developer or directly from a seller.

Buyers must make a minimum 10% down payment when purchasing a property. This means if a house costs RM400,000, you must pay at least RM40,000 upfront.

However, if you have the means of paying more than 10%, feel free to do so as it will reduce your monthly repayments and total home loan repayment schedule.

2. Legal Fees on SPA

The SPA is a mutual agreement between both parties, so it cannot be further negotiated or changed, and its cancelation will result in a penalty of 10% of the purchase price.

Always make sure you fully understand it before signing on the dotted line!

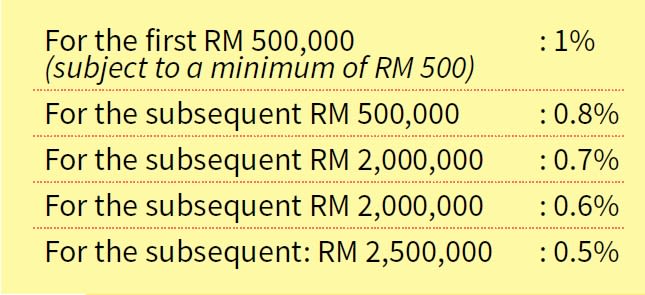

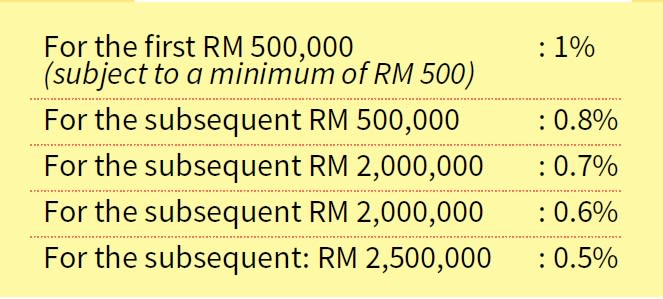

Legal fees for preparing the Sale and Purchase Agreement (SPA) are calculated as a percentage of the purchase price, ranging from 0.5% to 1% depending on the value of the apartments.

Other details you may find in the SPA are the method of payment, defects liability period, house/unit plan, free possession and various clauses.

3. Stamp Duty on SPA

Stamp duty is an unavoidable cost of buying property. It is the tax levied on your documents when you sell or transfer the property.

It is also a legal requirement and must be stamped within 30 days of signing the SPA or you may well end up having to pay a late penalty.

The stamp duty for the SPA is usually 1% to 3% of the SPA amount.

4. Legal Fees on Loan Agreement

Most of us will need a home loan to support our home purchase. Therefore, when you apply for a home loan, you will need to enter into another agreement called Loan Agreement.

A bank attorney must prepare the Loan Agreement and complete the Loan Agreement by ensuring that all necessary steps have been taken before the bank releases the money to the seller.

The Loan Agreement Legal Fees is approximately 0.5% to 1% of the property price. This includes a professional solicitor's fee, a disbursement fee and stamp duty.

5. Stamp Duty on Loan Agreement

It is also important to consider the stamp duty that is payable on any loan agreement that may be entered into as part of a property purchase.

As an important legal document, the loan agreement is also subject to stamp duty. Stamp duty on a loan agreement is a flat rate of 0.5% and is applied to the full value of the loan.

6. Stamp Duty on Memorandum of Transfer

Another document that the buyer may be required to sign is the Memorandum of Transfer (MOT).

The MOT is a document signed to transfer ownership of the unit from the previous owner to the next owner.

The stamp duty for the Memorandum of Transfer (MOT) is usually charged between 1% to 4% of the property purchase price.

7. Mortgage: MRTA or MLTA

There are two types of mortgage insurance on the market - Mortgage Reducing Term Assurance (MRTA)

and Mortgage Level Term Assurance (MLTA).

Although it is not necessary to purchase mortgage insurance, it provides security in the event of illness, disability or death by helping to pay off the outstanding home loan.

MRTA would be more suitable for those who are single and have no family members depending on them, as the beneficiary of the insurance will be the bank in the event of a tragedy.

However, if you have many dependents, it would be best to opt for MLTA as the payout would be made to your beneficiary or directly to you.

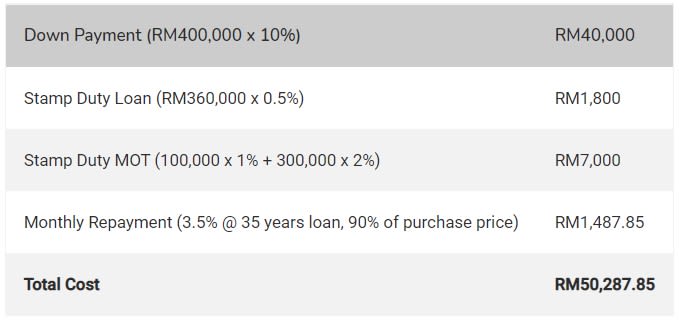

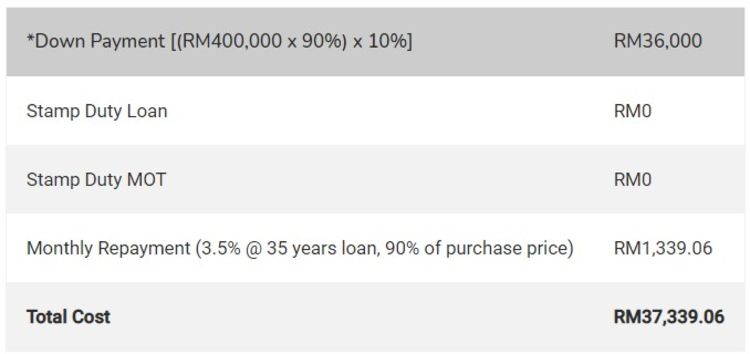

So, let's say you're buying a property at RM400,000...

What are your entry costs?

Without HOC, you'd have to pay...

With HOC, you'd only have to pay...

Learn more about HOC here.

Ready to make your purchase?

So if you're buying property for the first time,

make sure you don't get blindsided and

put some money aside for those other expenses.

Are you looking for the perfect one?

Well, you're one step closer to saying "I do" to the house

of your dreams. Fill out the form below and

we'll take care of the rest for you.

Follow us on Facebook and Instagram for

more home inspirations, guides and news.