How To Sell Property In Malaysia

3 steps to sell property from the Letter of Offer to RPGT.

Selling property may sound simple, but it can be a time consuming and complicated matter especially for first-timers. If buying a property is the first big step a person can make in life, then selling a property will be the second. Whatever the reason for selling property, all of us have the same goal - to reap the benefits of capital appreciation on a property.

Selling property shouldn't be a stressful experience, as long as you have a good preparation to make sure everything goes out smoothly. It is a very important decision to make, therefore it is crucial to know the proper steps.

Our Tax Guide: Buy, Rent & Sell ebook is available for download.

Let's say that Jackson, a Malaysian citizen has found a potential buyer who is genuinely interested in buying his property, and he is now on his way to negotiate the price alongside with his agent. What's next?

Step 1: Letter of Offer

Once Jackson and his buyer reached an agreement of the price, it is time to sign a Letter of Offer, also known as "Letter of Offer to Purchase" or an "Agreement to Purchase". An estate agent will normally ask a buyer to pay an earnest deposit of between 2-3% of the offered sum when they create the letter and they normally keep the earnest deposit in their client’s account as stakeholders from the date the offer is made until the execution of the Sales & Purchase Agreement.

A letter of offer usually contains the following information:

- The legal names of the vendor (seller) and buyer

- The legal address of the property

- The price that has been agreed upon

- The deposit amount

- Any items such as fittings included in the sale

- The date before which the sale and purchase agreement must be signed

Step 2: Sales and Purchase Agreement

Once the letter of offer has been accepted, the lawyer will prepare some legal documents for the sale. When the buyer implements the SPA they will pay the balance of the first 10% of the purchase price. The documents will be sent to Jackson for implementation and will then be stamped. All this must be done within 14 days (2 weeks) of the signing of the “Letter of Offer”.

Standard SPA terms state that the remaining 90% will be payable to Jackson within three months from when the SPA is signed and stamped. However, the time- period may vary depending upon the agreement, the property type, who Jackson deals with and the mode through which Jackson acquires the property.

Step 3: Real Property Gain Tax (RPGT/CKHT)

Down to the final stretch, once all the payments are made and all the documents are done, the property will successfully be sold and ownership transferred to the buyer.

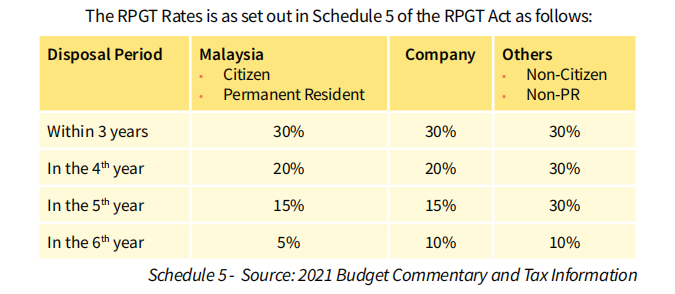

Real Property define in Section 2 of the RPGT Act to mean any land situated in Malaysia. Jackson’s property has situated in Kota Kinabalu, Malaysia. Therefore, any gains arising from the disposal or selling of real properties will be charged for Real Property Gains Tax (RPGT).

Remember, this is just a basic guide on how to sell your property. When you are ready to sell your property, be sure to carefully do your inspections, research the matter and most importantly get a good real estate agent to help you through the process.

You can now sign tenancy agreements electronically on Property Hunter! Learn more about E-Tenancy here.

Follow us on Facebook or Instagram for more home inspirations, guides and news.