Buying a property, is not any easy task.

There are many steps to follow before you can get the keys for the property you have bought. One of the most important task is getting a bank loan. Unless you buy cash, you will need to borrow from the bank.

Today, getting loan approval is an uphill task. The banks require more documents proof and also they will check on your status before granting the approval.

In this article, I will share on what you need to know in applying a loan in Malaysia.

Here are the steps from loan submission to approval.

Step 1: Choose bank and loan package

Step 2: Prepare Financial documents

Step 3: Bank submission

Step 4: Approval/ rejection

If approved, you then sign a Letter of Offer.

There are many bank loan packages. These are to attract borrowers to borrow from the bank. I categorise 3 main types of loan packages for easy understanding. Any packages promoted by the banks falls under these categories.

Semi-Flexi Loan

This is the most basic type. Another term the banks uses is Conventional Loan or Term Loan. The loan consists of principal and interest. The interest can go up or down depending on the market prevailing rate set by Bank Negara Malaysia (BNM).

If the borrower wants to pay any additional monies to bring down the principal, they can do so by informing the bank. Normally in multiple thousand. In most banks you do not have to pre-inform the bank. Just walk in the bank branch and sign the form. You can immediately pay down your loan.

If you do not inform the bank, the system will automatically treat this as prepayment and it goes into next month instalment payment. You will not enjoy the interest savings. Many borrowers make this mistake.

Apart from conventional package, there is also overdraft. Borrowers will pay interest rate only. Borrowers can pay more and it will go into principal reduction. In this account you don’t have to inform the bank. Borrowers will have to open a current account to utilise this facility.

Interest rate is much higher than conventional loan. It is suitable for businessman or borrowers who have high transactions every month. Every time the borrowers have additional money in the account, he/she will save on interest.

Flexi-Loan

As the name suggest, this type of loan is very flexible. What is the different than semi-flexi? I can say that it is the combination of conventional loan and overdraft into one account.

You can also issue a cheque in this account. The borrowers can treat this as their current account. Borrowers will still pay their minimum monthly repayment but any additional amount pay into this account will be considered as principal reduction. Thus, this in turn will reduce the interest rate charge.

The borrowers can withdraw any amount in this account without informing the bank. Interest will be charge back on the utilize portion.

Fixed Loan

In this category, the interest is fixed. It means that the monthly installment is fix no matter there will be a fluctuation in the interest rate. In Malaysia, banks and insurance companies offered such a package. Banks offered under Islamic loan.

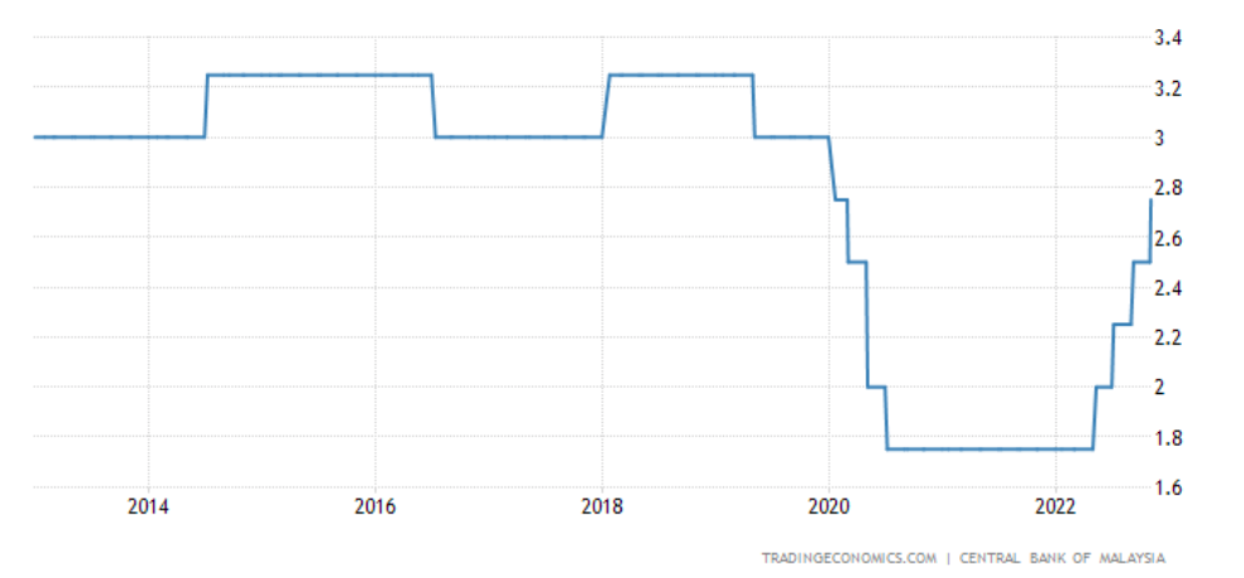

Malaysia’s interest rate depends on Overnight Policy Rate (OPR) set by the central bank. OPR is the rate where the banks lend money to each other overnight. The fluctuation in OPR will determine the rate the borrowers will have to pay to the banks.

OPR Rates in Malaysia (2014 -2022)

The current OPR is 2.75% as 3rd November 2022. The OPR increase by 25 basis point or 0.25%. It is the fourth consecutive increase in year 2022.

|

Date |

Change in OPR |

New OPR |

|

03 Nov 2022 |

+0.25% |

2.75% |

|

08 Sept 2022 |

+0.25% |

2.50% |

|

03 Jul 2022 |

+0.25% |

2.25% |

|

11 May 2022 |

+0.25% |

2.00% |

|

07 July 2020 |

-0.25% |

1.75% |

|

03 May 2020 |

-0.50% |

2.00% |

|

03 Mar 2020 |

-0.25% |

2.50% |

In Malaysia there are 3 types of rate.

- Base Lending rate (BLR)

- Base Rate (BR) – replace BLR from 2nd January 2015

- Standardised Base Rate (SBR) – Effective 1st August 2022

Please take note that the new SBR does not affect existing borrowers whose calculation is based on BLR and BR. SBR is for new borrowers from 1st August onwards.

For easy understanding here it is how calculation is done.

Standardised Base Rate (SBR) + Spread = Effective Lending Rate (ELR)

Example:

2.75% (SBR) + 1.05% (spread) = 3.8% (ELR)

*SBR is price accordance with OPR and it will fluctuate. SBR promotes easier understanding on interest rate as all the banks have the same standard interest rate.

*Spread will varie, depending on the bank. It will be fixed throughout the loan tenure unless there is default on the loan repayments. The banks have the right under the loan agreement to increase the spread interest. If the borrower is a foreigner the spread can be higher.

*ELR is the final interest rate you will pay to the bank. Borrower will be able to compare ELR of each bank before making a decision.

|

Bank |

SBR |

Base Rate (BR) |

BLR |

Indicative Effective Lending Rate |

|

Affin Bank |

2.75% |

3.70% |

6.56% |

4.30% |

|

Alliance Bank |

2.75% |

3.57% |

6.42% |

4.11% |

|

CIMB |

2.75% |

3.75% |

6.6% |

TBA |

|

Maybank |

2.75% |

2.75% |

6.4% |

4% |

|

Public Bank |

2.75% |

3.27% |

6.47% |

TBA |

|

RHB Bank |

2.75% |

3.50% |

6.45% |

TBA |

|

AmBank |

2.75% |

3.6% |

6.45% |

4% |

Source: as of November 2022, from their respective bank websites.

The maximum loan tenure for residential properties is age 70 years old or maximum 35 years whichever is lower. There are banks who offer lower loan tenure and maximum age.

Margin of Finance (MOF)

For residential properties under individual borrowing is 90% for first 2 properties, thereafter is 70% on the sale price of open market value whichever is lower.

If you were to use company, the maximum MOF for residential property is 60%.

Commercial properties MOF is 85%.

I hope that you have a clear understanding on how loan works in Malaysia. There is more learning on this topic. Subscribe to my online video on Mortgage Masterclass. I have more than 3 hours videos break into 30 sections for easy learning.

Please key in GMT1212 for a special price.

If you want to know more about me, you can go to www.miichaelyeoh.com or follow me in facebook.