Malaysia’s property market is in a 2020 tailspin.

Is there hope for Sabah in 2021?

An economic review of the property market in 2020 and major launches in Sabah amidst the pandemic.

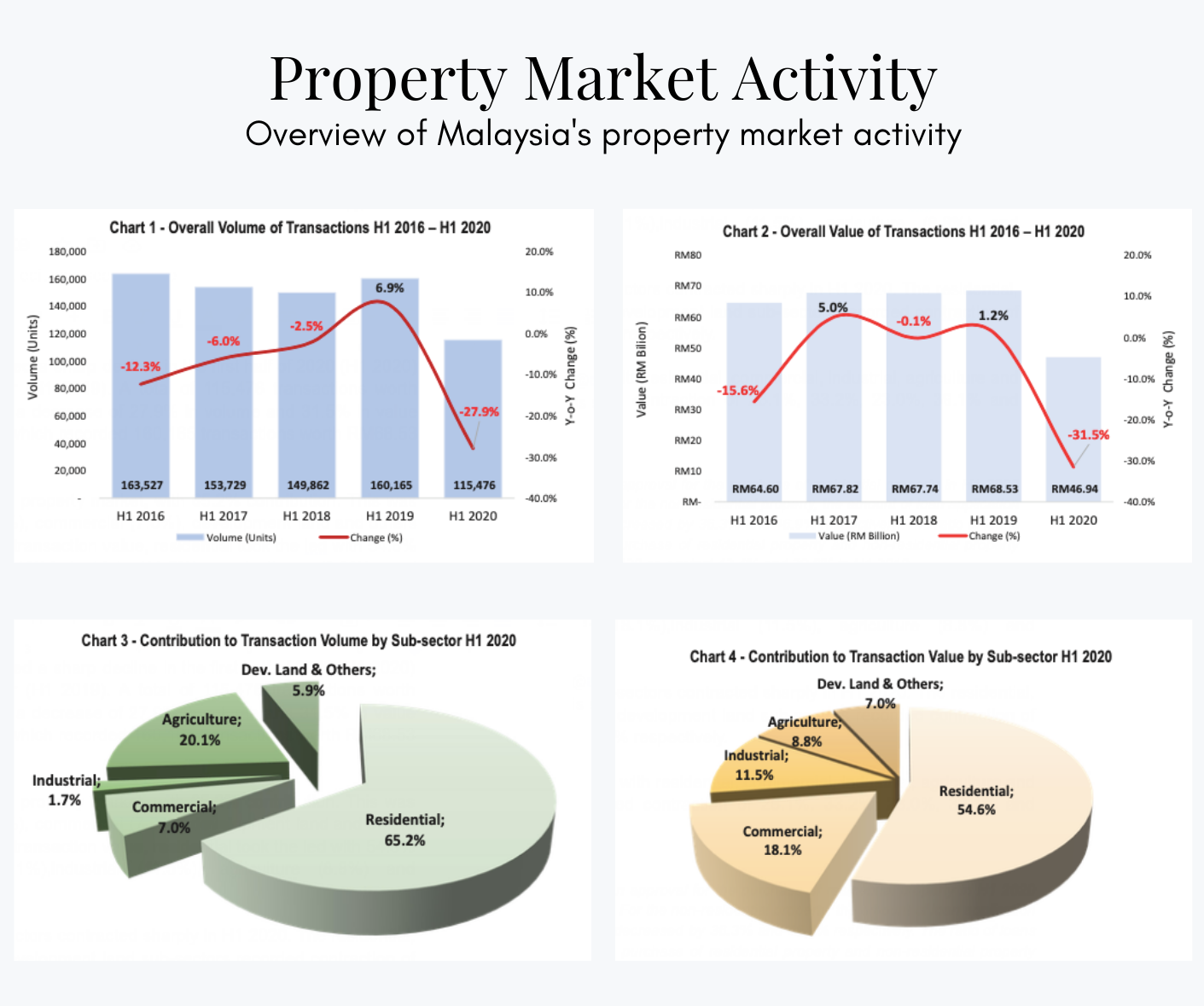

A quick glance at the property market activity in Malaysia in 2020

Out of the 115,476 total transactions worth RM46.94 billion, residential sub-sector contributed the most in terms of volume and value with 65.2% and 54.6% respectively. Source: National Property Information Centre (NAPIC)

Out of the 115,476 total transactions worth RM46.94 billion, residential sub-sector contributed the most in terms of volume and value with 65.2% and 54.6% respectively. Source: National Property Information Centre (NAPIC)

Property volume and value transactions recorded a sharp decline in the first half of 2020

The overall property market performance in Malaysia recorded a sharp decline in 1H2020 compared to the same period last year (1H2019). A total of 115,476 transactions worth RM46.94 billion were recorded and a decrease of 27.9% in volume and 31.5% in value compared 1H2019 (160,165 transactions worth RM68.53 billion).

Compared to 1H2019, the volume of transactions across the sub-sectors decreased sharply in 1H2020. The residential, commercial, industrial, agriculture and development land sub-sectors recorded a decline of 24.6%, 37.4%, 36.9%, 32.8% and 28.6% respectively.

Meanwhile, the value of transactions also simultaneously decreased in 1H2020 compared to 1H2019. The residential, commercial, industrial, agriculture and development land sub-sectors recorded a decline of 26.1%, 33.2%, 23.0%, 39.1% and 55.3% respectively.

The residential sub-sector is anticipated to improve with government initiatives such as the extension of the Home Ownership Campaign (HOC), exemption of Real Property Gains Tax (RPGT), Rent-to-Own (RTO) scheme and lower foreign ownership threshold to address the prolonged property overhangs.

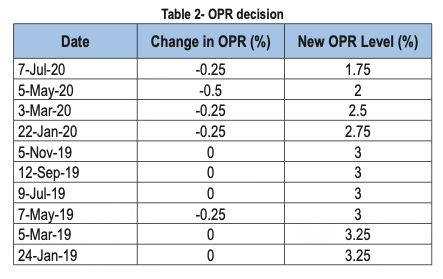

Home loan instalment is cheaper for new property purchasers with the OPR cut, but loan approvals remain rigid

From January 2020 until July 2020, The new OPR level announced by Bank Negara Malaysia only gets lower. Source: National Property Information Centre (NAPIC)

From January 2020 until July 2020, The new OPR level announced by Bank Negara Malaysia only gets lower. Source: National Property Information Centre (NAPIC)

Loans application and total loan approval for the purchase of residential property in H1 2020 decreased by 24.1% and 39.1% respectively. The ratio of loans approvals against loans applications for the purchase of residential is 34.1% in 1H2020 against 42.4% in 1H2019 which shows a rigidity in loan approvals.

The amount of loan application and total loan approval for non-residential property also saw a similar pattern with a decrease by 36.3% and 46.9% respectively. The ratio of loans approvals against loans applications for the purchase of non-residential property stood at 33.0% against 39.6% in 1H2019.

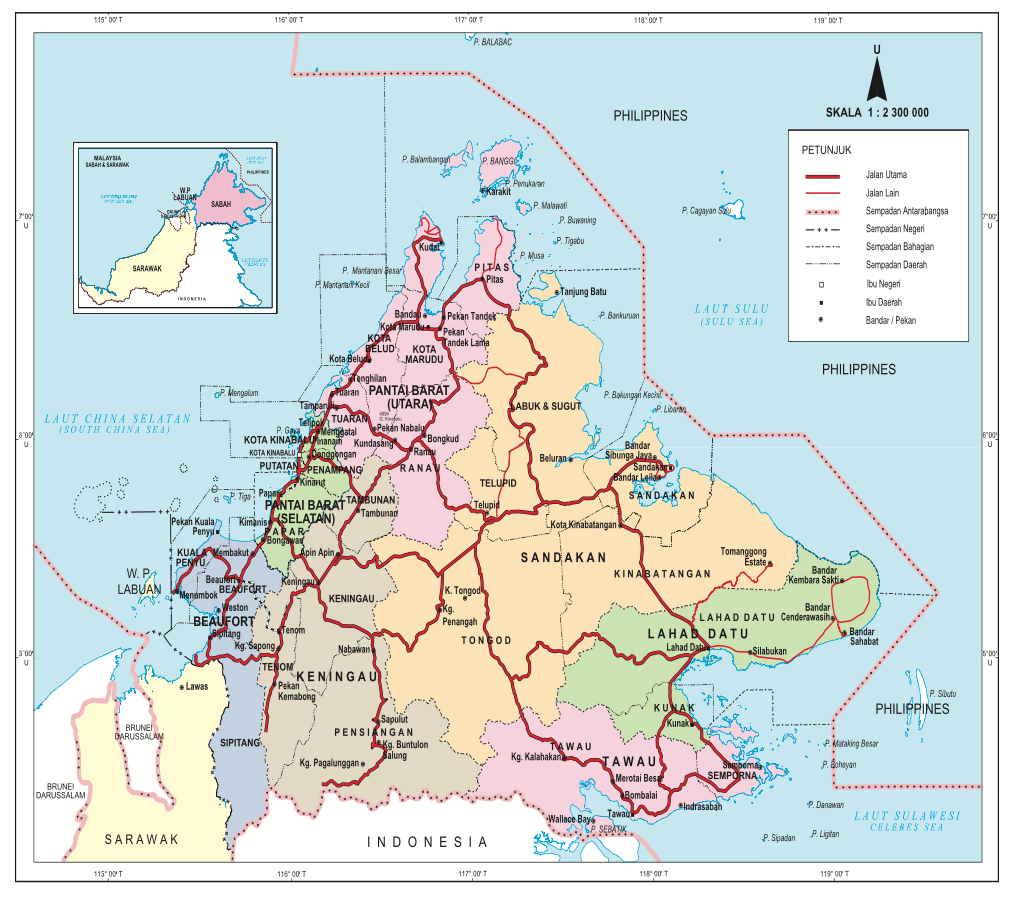

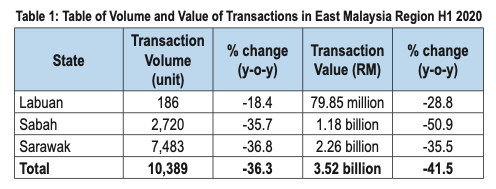

The Property market in Sabah is not spared from the sharp decline

As of 1H2020, Sabah recorded a total population of 3.91million with median household income of RM4,235. Source: National Property Information Centre (NAPIC)

As of 1H2020, Sabah recorded a total population of 3.91million with median household income of RM4,235. Source: National Property Information Centre (NAPIC)

The year-on-year performance of Sabah property market significantly softened in 1H2020 as compared to 1H2019. Sabah recorded a decrease by 35.7% and 50.9% in volume and value respectively as compared to 1H2019. Source: National Property Information Centre (NAPIC)

The year-on-year performance of Sabah property market significantly softened in 1H2020 as compared to 1H2019. Sabah recorded a decrease by 35.7% and 50.9% in volume and value respectively as compared to 1H2019. Source: National Property Information Centre (NAPIC)

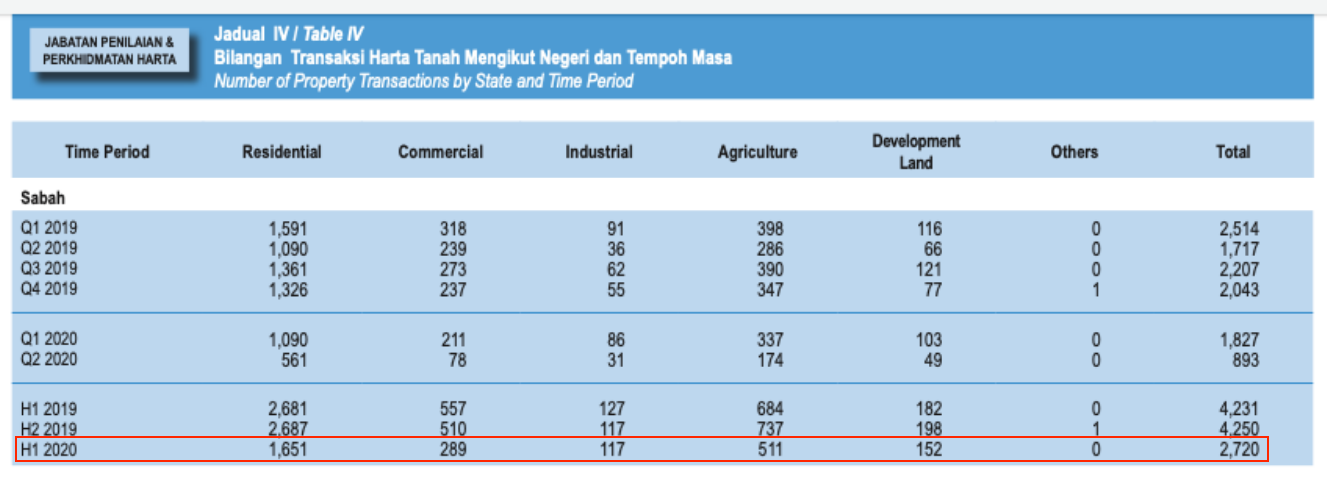

A grasp of Sabah property market in 1H2020 against 2H2019

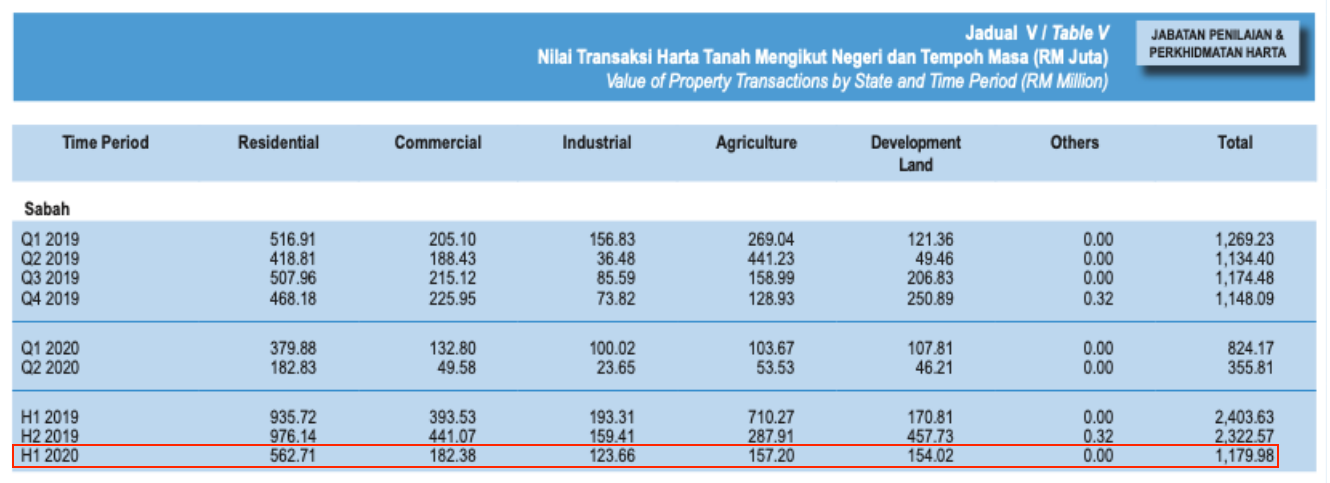

Sabah’s property market observed a slowdown in transactional activity, in terms of both volume and value of property transactions in 1H2020. A total of 2,720 property transactions were recorded in 1H2020, a decline of 36% in volume in comparison to the preceding half (2H2019: 4,250 transactions). Meanwhile, the overall value of transactions for 1H2020 registered at RM1.18 billion was lower by 49.2% compared to RM2.32 billion in 2H2019.

Sabah recorded 2,720 units of property transacted in the first half of 2020. Source: National Property Information Centre (NAPIC)

Sabah recorded 2,720 units of property transacted in the first half of 2020. Source: National Property Information Centre (NAPIC)

There is a significant decline in the total value transacted in 1H2020 (RM1.18 bil) measured against 2H2019 (RM2.32 bil). Source: National Property Information Centre (NAPIC)

There is a significant decline in the total value transacted in 1H2020 (RM1.18 bil) measured against 2H2019 (RM2.32 bil). Source: National Property Information Centre (NAPIC)

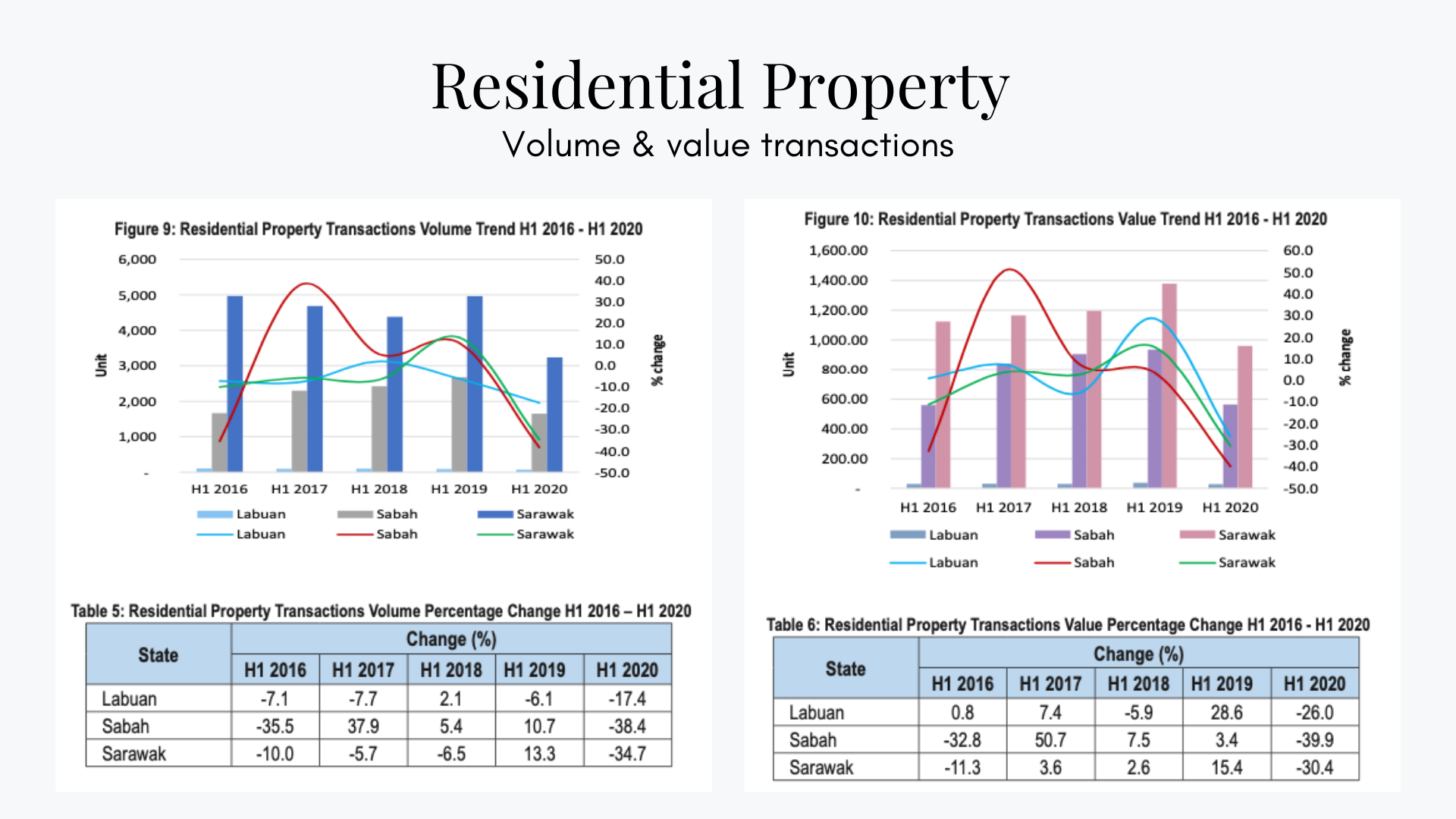

Residential sub-sector in Sabah recorded a double-digit decline

In Sabah, a total of 1,651 units valued at RM562.71mil of residential property were transacted in 1H2020. Source: National Property Information Centre (NAPIC)

In Sabah, a total of 1,651 units valued at RM562.71mil of residential property were transacted in 1H2020. Source: National Property Information Centre (NAPIC)

Residential sub-sector is the main sub-sector and Sabah recorded a double-digit decline on y-o-y transaction volume and value by 38.4% and 39.9% respectively. Nevertheless, residential property accounted for most transacted among other sub-sectors in Sabah, taking up 60.7% of the total unit and 47.7% of the total value transacted.

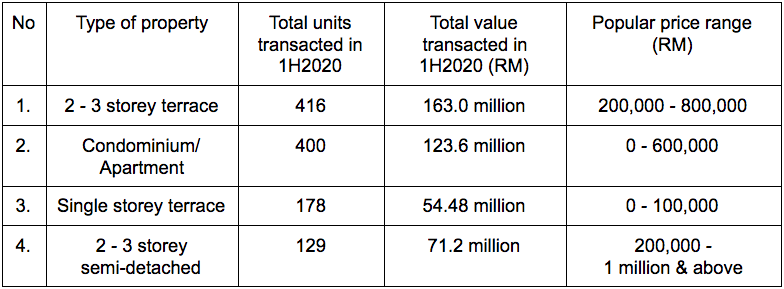

What are the recent most popular types of residential properties in Sabah?

Home buyers still favor 2 - 3 storey terrace in 1H2020 after 691 units transacted in 2H2019 which is also the highest in the preceding half. Condominium or apartment are also a popular choice among home buyers in Sabah, with only a slight difference in number. Source: National Property Information Centre (NAPIC)

Home buyers still favor 2 - 3 storey terrace in 1H2020 after 691 units transacted in 2H2019 which is also the highest in the preceding half. Condominium or apartment are also a popular choice among home buyers in Sabah, with only a slight difference in number. Source: National Property Information Centre (NAPIC)

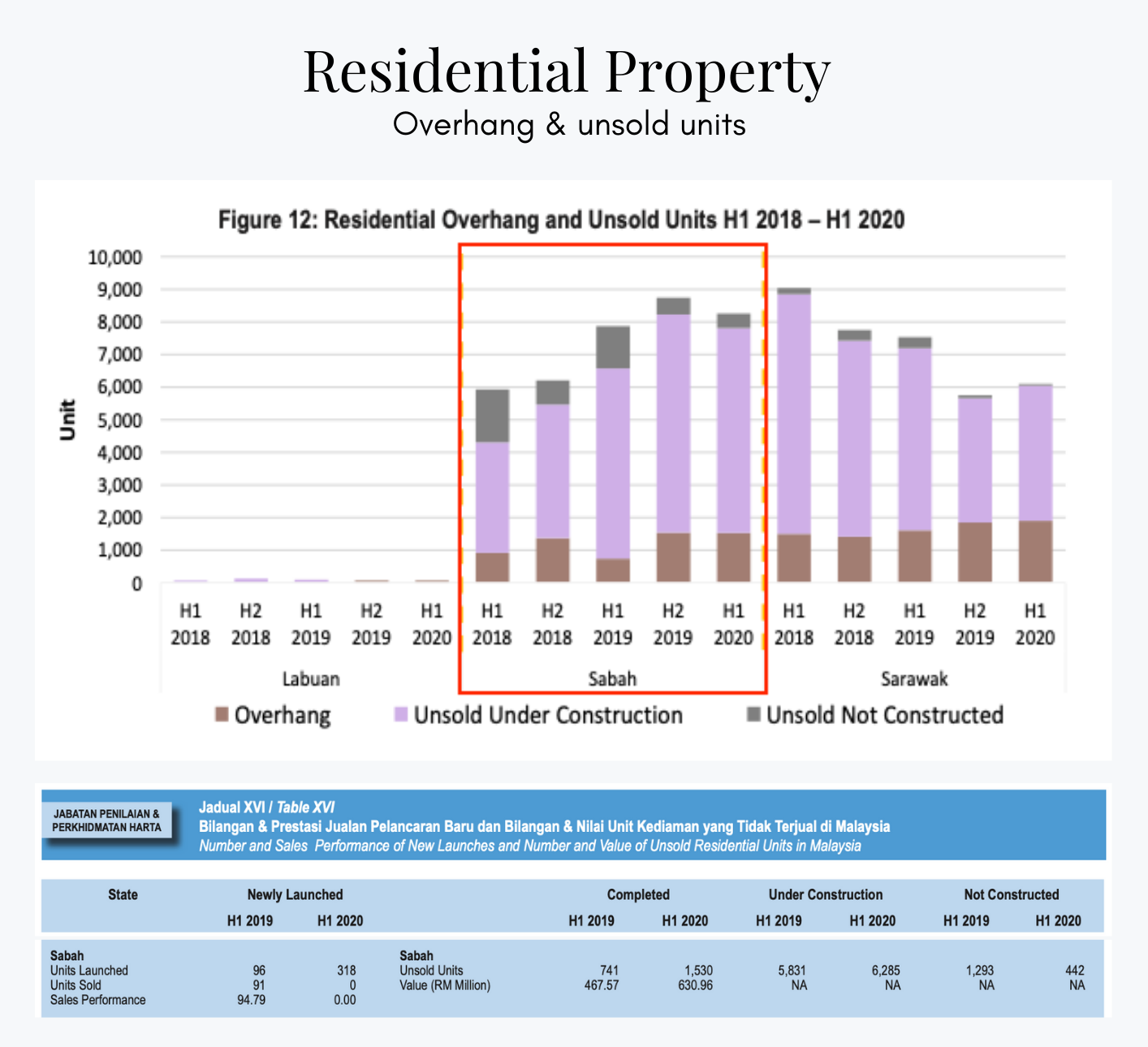

In Sabah, residential property overhang situations has slightly improved

Overall, residential overhang situations improved in the 1st half of 2020 compared to the 2nd half of 2019 in Sabah. Source: National Property Information Centre (NAPIC)

Overall, residential overhang situations improved in the 1st half of 2020 compared to the 2nd half of 2019 in Sabah. Source: National Property Information Centre (NAPIC)

Malaysia recorded 31,661 units worth RM20.03 billion of unsold residential property in 1H2020. Sabah accounted for 1,530 (4.83%) unsold completed units worth RM 630.96mil (3.15%). Likewise, the unsold ‘under construction’ in Sabah reduced by 6.0% to 6,285 units compared to 2H2019 (6,683 units).

The reintroduction of Home Ownership Campaign (HOC) 2020 - 2021 is expected to make the housing market more accessible to genuine homebuyers and at the same time easing the state’s property overhang after successfully the campaign generating RM948.9 million worth of sales in 2019.

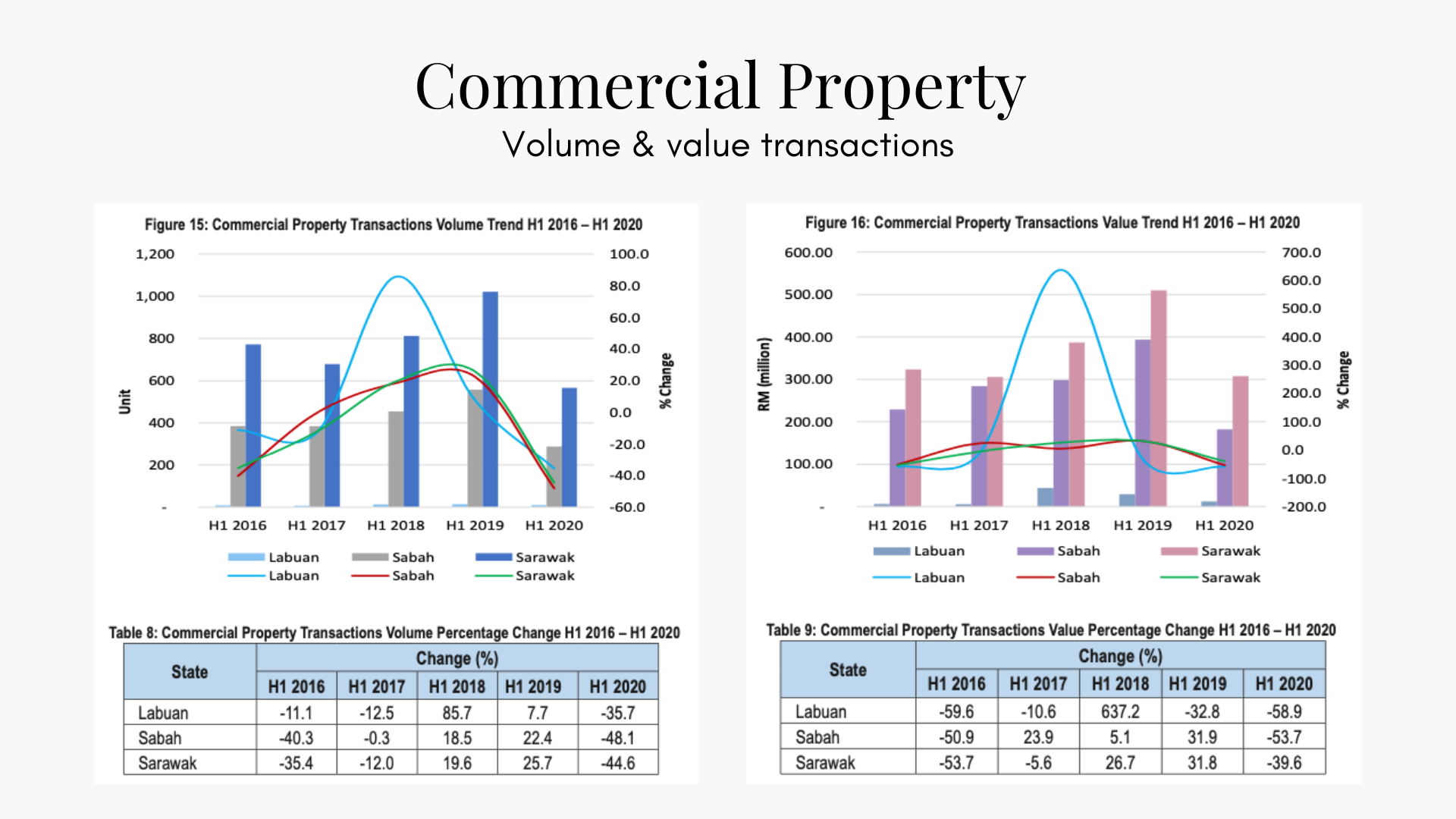

Commercial property transactions performance in Sabah has dropped by half

Commercial sub-sector in Sabah showed a significant downtrend in terms of value and volume transacted compared to the past 3 years. Source: National Property Information Centre (NAPIC)

Commercial sub-sector in Sabah showed a significant downtrend in terms of value and volume transacted compared to the past 3 years. Source: National Property Information Centre (NAPIC)

In 1H2020, the overall commercial property in Sabah recorded a total transaction of 289 units valued at RM182.38mil. Commercial sub-sector in Sabah recorded a double-digit decline in y-o-y transaction volume and value by 48.1% and 53.7% respectively.

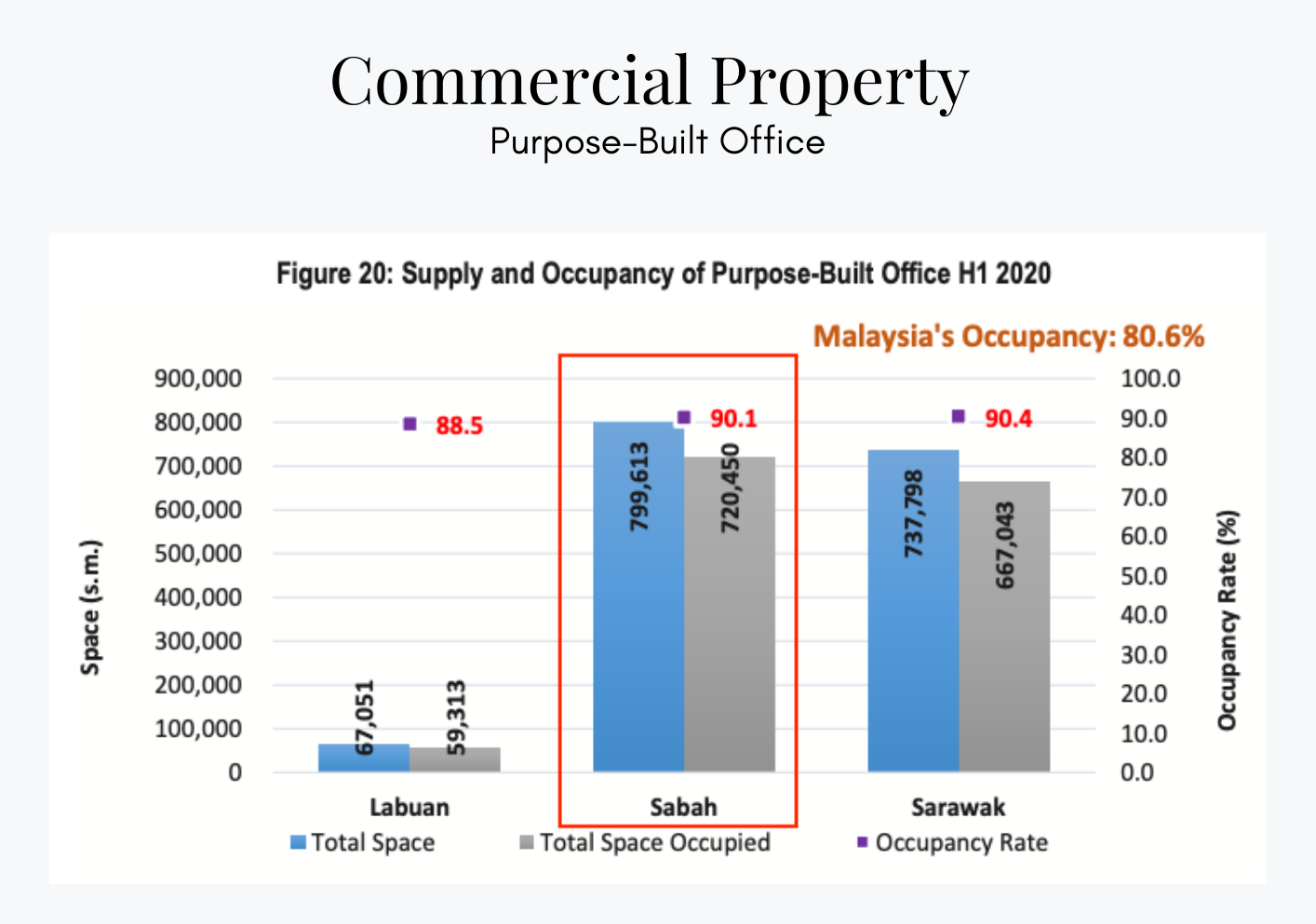

Purpose-built office occupancy rate increased to 90.1% with a minimum gross rental yield of RM2.00

On top of the 100 buildings (799,613 s.m.) supply, there are also 2 buildings (19,252 s.m.) incoming and 1 building (13,632 s.m.) planned supply in Sabah. Source: National Property Information Centre (NAPIC)

On top of the 100 buildings (799,613 s.m.) supply, there are also 2 buildings (19,252 s.m.) incoming and 1 building (13,632 s.m.) planned supply in Sabah. Source: National Property Information Centre (NAPIC)

The performance of purpose-built offices was generally stable. The occupancy rate in Sabah increased to 90.1% compared to 2H2019 (Sabah 87.1%). Prime CBD office space rentals remained constant with asking gross rental ranging from RM4.00 to RM6.00 per sq ft per month while non-prime CBD office command gross rental of RM2.00 to RM4.20 per sq ft per month. The beginning of 2020 witnessed the entry of more commercial properties that offer the flexibility of catering to short-term accommodation (STA) or for own use.

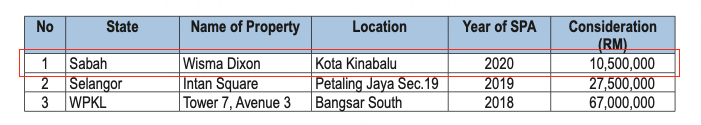

1H2020 also witnessed the transaction of Wisma Dixon purpose-built office in Jalan Pantai, Kota Kinabalu with a consideration of RM 10.5mil. Source: National Property Information Centre (NAPIC)

1H2020 also witnessed the transaction of Wisma Dixon purpose-built office in Jalan Pantai, Kota Kinabalu with a consideration of RM 10.5mil. Source: National Property Information Centre (NAPIC)

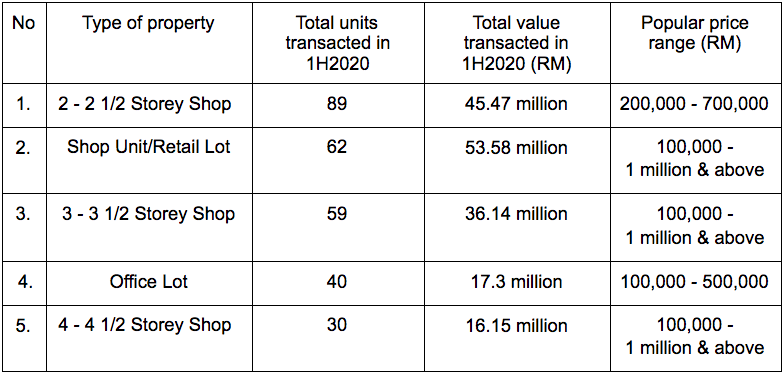

What are the recent most popular types of commercial properties in Sabah?

In Sabah, 2 - 2 1/2 storey shop is still the most transacted in 1H2020 after 152 units transacted in 2H2019 which is also the highest in the preceding half. Source: National Property Information Centre (NAPIC)

In Sabah, 2 - 2 1/2 storey shop is still the most transacted in 1H2020 after 152 units transacted in 2H2019 which is also the highest in the preceding half. Source: National Property Information Centre (NAPIC)