Making Homes Affordable

A live discussion, hosted by SHAREDA, to detail the available affordable housing schemes for the B40 and M40 groups in Sabah

In efforts to further stimulate the economy and encourage homeownership, it was announced that the Home Ownership Campaign (HOC) has been extended until the end of 2021.

In a webinar, last night, hosted by Sabah Housing And Real Estate Developers Association (SHAREDA) on Facebook, the HOC and many other ways the B40 and M40 group can own a home in 2021 were explained in great detail.

“By conducting this webinar tonight, we hope that not only does it bridge the government and private sector but we also hope that it bridges the heart of the rakyat.”

Mr Benny Ng, Secretary-General of SHAREDA, offered at the end of the fruitful discussion. “Technology is improving every day and with the help of these talks, the public can learn more about how these policies work and how it can help them own a home.

Skip to content:

The Home Ownership Campaign Explained

The extension of HOC has been a hot topic in the world of real estate and was addressed in the beginning of the session as viewers were eager to hear how the initiative could directly benefit them as potential homebuyers.

There are five main incentives under HOC 2021:

HOC 2021 five main incentives

HOC 2021 five main incentives

- The first being a full exemption of the stamp duty on Memorandum of Transfer for homes priced between RM300,000 to RM1 million.

- For properties priced between RM1 million and RM2.5 million there is a stamp duty reduction of just 3% stamp duty.

- Stamp duty fees have been exempted as well for all legal documents signed during the purchase of a home. Additionally, the Sabah Law Society have kindly offered a 25% legal fee discount for all HOC home buyers in Sabah.

- Developers that join HOC also give a 10% discount on properties, although it is not compulsory in Sabah and Melaka.

- Lastly, HOC only applies to the primary market meaning homebuyers are guaranteed to buy new homes only.

Terms and conditions apply to the HOC including that applicants must be Malaysian citizens and must buy properties registered under SHAREDA, REHDA and SHEDA, within the campaign period.

There is also a 70% margin of financing limit applicable for the third housing loan onwards. For further information on HOC, you can contact SHAREDA directly.

How much can you actually save with HOC?

Here’s a calculation of savings if you were to buy a home worth RM500,000 under HOC.

MOT Stamp Duty + Loan Agreement Stamp Duty + SPA Stamp Duty

= {(1% × 100k) + (2% × 400k) } + 0.5% of housing loan amount (90% of RM500k) + SPA RM40

= RM1,000 + RM8,000 + RM2,290

= RM11,290

Additional 10% discount that developers are required to offer as well = RM50,000

Total savings of RM61,290.

Solutions to Mismatched Properties and End Financing

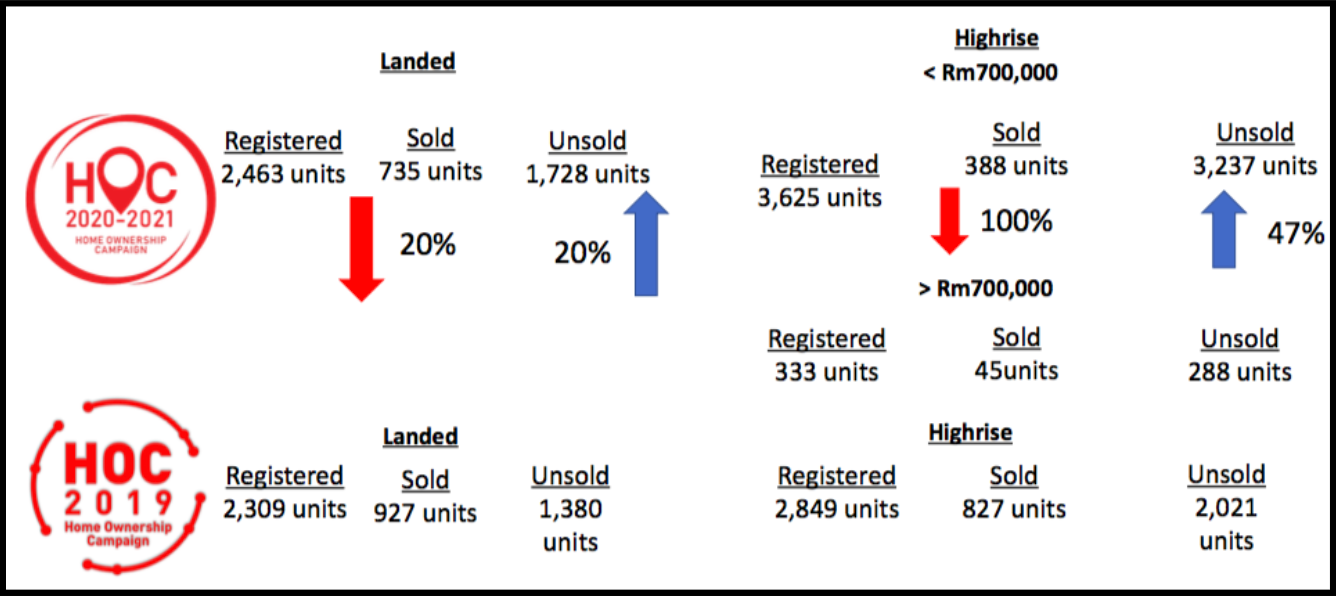

The data from HOC 2019 and HOC 2020-2021 revealed important links that President of SHAREDA, Datuk Chua Soon Ping was able to analyse and explain.

Webinar screenshot of HOC 2019 and HOC 2020 - 2021 data.

Webinar screenshot of HOC 2019 and HOC 2020 - 2021 data.

“We see here that there is more of a dramatic drop when it comes to the sold units of highrise properties compared to landed properties. Purchasers are looking more towards landed homes while at the same time there has been more highrise development. There are two solutions to this surplus of highrise units. What we can do is offer this to foreign ownership.”

Datuk Chua explained, touching on one of his initiatives as president of SHAREDA to rebuild the Sabah economy - by lowering the threshold for foreigners to buy homes in Sabah and spur activity in the market.

“We are also working with the banks.” Datuk Chua added, for those that are struggling with cash flow and cannot afford the initial costs of buying a home.

Maybank is offering Houzkey which is a type of Rent-To-Own scheme. This allows the buyer to sign a Sales and Purchase Agreement (SPA) to own the home but only pays a 3 month deposit of installment and rents the home for 5 years before buying the property.

CIMB offers a 30 year plan that reduces payments by 20% for the first 5 years. The buyer will pay the remaining amount over the next 25 years.

What makes a home affordable?

Land and homes are believed to be “expensive” in the city of Kota Kinabalu, as viewers voiced out in the comments of the webinar. A few factors that contribute to this viewpoint were explained briefly, such as land scarcity and inflatted prices of imported materials, but to understand affordability, the income groups and housing demand must first be understood.

Deputy Permanent Secretary of the Ministry of Local Government and Housing (KPKT), Mr Stanley Chong said that we as the people must first identify which household income group that we belong to.

“The state government and Ministry of Local Government and Housing focuses on providing affordable homes for the community of the B40 group before the M40 group” he said.

“The reason being is that we rely on the private sector like SHAREDA to provide home initiatives for the M40 group. If we look at the median income in Malaysia, Sabah has the lowest median household income of RM4,235 (B40). Apart from Kota Kinabalu, Penampang and other main districts in Sabah, most communities in Sabah are actually in the lower range of the B40 group.”

Housing Schemes for Lower to Medium Income Groups

Mr Chong reiterated, “When we look at the low cost housing demand in Sabah from 2020, we find that out of the 64,017 applicants, the gross household income was between RM750 to RM3000 per month. This is why the government needs to look into providing homes for this community of people who do not own homes or land.”

With this insight in mind, it begs the question - how can most Sabahans in the B40 group afford to own a home? This is the mission of KPKT and therefore offer the following housing schemes to provide homes for Sabahans with a lower income.

1. MyHome Scheme

The Skim Perumahan Mampu Milik Swasta (MyHome) offers buyers up to RM 30,000 rebate per unit. In Sabah & Sarawak, the homes range from RM90,000 to RM250,000 and the eligible monthly income group range from RM3000 to RM6000 (applying to both the B40 and M40 group). Applicants must be first-time homebuyers and can apply online at Sistem Pengurusan Perumahan Negara (SPRN) website.

2. LPPB Low-Cost Housing Scheme

This scheme offers low-cost semi-detached, terraced and apartment homes priced between only RM30,000 to RM47,000. The construction of these homes is paid for by the government. 29,218 units have been completed and under the 12th MP (2021 – 2025), LPPB will develop 175 units of Public Low Cost Housing Scheme. B40 applicants can apply on the LPPB website or visit the office for further assistance.

3. Housing Loan Scheme For Low Income Group (SPPUGBR)

An affordable housing scheme provided by the Federal Government for low-income groups (Non-Government Employees) with a loan amount not exceeding RM50,000. The loan provides for the construction of homes should the applicant own land or for the purchase of public houses. It is eligible for buyers with a monthly income of RM500 to RM1500 and can be applied for on the LPPB website or office.

4. LPPB’s Long House Loan Scheme (SPRP)

Provided for the low-income Bumiputeras in Sabah, while preserving the tradition of the longhouse community, with a total loan not exceeding RM75,000. Note that the design of these homes are not the stereotypical longhouse, they are similar to long terraced homes. Applicable on the LPPB website or office.

5. People's Housing Program (PPR)

A type of Rent-to-own scheme that allows buyers to sign a SPA and rent the property before deciding to buy it. The conditions will be confirmed once it has been approved for the 12 Malaysia plan. The area per unit is 900 sq. ft and the sale price is between RM190,000 and RM230,000 per unit.

The Way Forward

The panelists ended the session with a call for all parties to communicate and work together to provide affordable housing including efforts from the state and federal government, financial institutions and private sectors.

You can watch the full and fruitful discussion on the SHAREDA Association Facebook page titled “Making Houses Affordable” and follow the page to keep up to date with future live talks, where they will be able to dive deeper on their initiatives and market analysis.